ITUP Blog: Key Highlights in the Governor’s FY 2022-23 May Revise

Governor’s FY 2022-23 Budget: Key Highlights in the May Revision

Governor’s Fiscal Year 2022-23 Budget May Revision: The Largest Budget in California History

On May 13, 2022, Governor Gavin Newsom released the May Revision of the Fiscal Year (FY) 2022-23 Budget. The total FY 2022-23 budget is $300.7 billion total funds (TF) ($227.5 billion General Fund (GF)) and includes a $97.5 billion one-time budget surplus. The budget surplus included in the May Revision surpasses the record-breaking predicted surplus of $76 billion projected in the January budget proposal and is the largest budget surplus in California history. As required by law, about half of the budget surplus will be spent on education and the other half is reserved for one-time spending including: $18.1 billion in financial relief in the wake of record-breaking inflation, $37 billion for infrastructure investments, and ongoing allocations for the continued COVID-19 response.[i] While California is in the midst of an unprecedented budget surplus, the Legislative Analyst’s Office notes that this is exceptional and should not be expected to be the standard in future years.[ii]

This publication highlights key health and human services proposals in the FY 2022-23 May Revision as well as proposals that improve health equity and address the social determinants of health. Following the summary of key budget highlights, we discuss what to expect during the months between now and the final budget, when the Governor will release a revised budget before it ultimately is signed into law this summer. We also include links to resources on where to find budget change proposals, trailer bill language, department-specific budget highlights, and more.

Key Highlights from the Governor’s FY 2022 – 23 May Revision

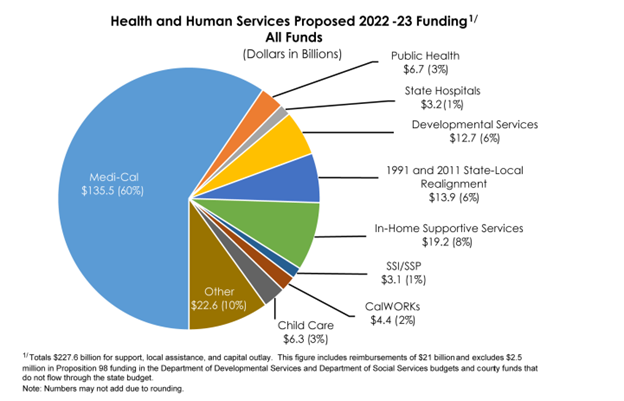

Below we highlight key health and human services proposals in the FY 2022-23 May Revision, as well as proposals that improve health equity and address the social determinants of health. Health and Human Services proposals make up a large portion of the revised budget with proposed expenditures of $277.6 billion ($67.4 billion GF and $160.2 billion other funds (OF)) (See figure below). [iii] The proposals highlighted below represent a fraction of the proposals included in the May Revision.

1. Budget Proposals Advancing Coverage and Access

Expansion of Full-Scope Medi-Cal Coverage to All Adults Regardless of Immigration Status: The January FY 2022-23 budget proposes to extend Medi-Cal coverage to adults aged 26 through 49 years, regardless of immigration status, no sooner than January 1, 2024. The May Revision and the out years include allocations to support several of the recent expansion efforts:

- Approximately $67 million TF ($53 million GF) in FY 2021-22 and $745 million TF ($628 GF) in FY 2022-23 in costs to expand full-scope Medi-Cal.

- $287 million TF ($197 million GF) in FY 2021-22 and $334 million TF ($226 million GF) in FY 2022-23 for the undocumented young adult population.

- $834 million TF ($625 million GF) in FY 2023-24 for a January 1, 2024, for implementation. [iv]

This expansion would cover an estimated 700,000 Californians and is anticipated to cost $819 million TF ($614 million GF) in FY 2023-24 and $2.3 billion TF ($1.8 billion GF) at full implementation.[v] See ITUP’s “Who are the Remaining Uninsured?” Fact Sheet for more information about who this proposal impacts.

Covered California Subsidies and Affordability: In 2021, the federal American Rescue Plan Act (ARPA) expanded federal marketplace health insurance subsidies through 2022, which took the place of state-funded subsidies for low- and middle-income consumers not eligible for federal subsidies. The GF dollars saved from ARPA last year totaled $333.4 million and were required by the Legislature [v] to be placed into reserves and used for future affordability programs. [ii] In January 2022, Covered California released a report “Bringing Care Within Reach” highlighting options for spending these funds. The May Revision proposes $304 million to reinstate California’s premium subsidy program for middle-income Californians in the event that the federal government does not extend their funding of those subsidies. [iv]

Office of Health Care Affordability: Unchanged from the January budget proposal, the May Revision includes $30 million GF to create the Office of Health Care Affordability within the Department of Health Care Access and Information (HCAI) with the intent of increasing price transparency, developing specific cost targets for different sectors of the health care industry, and imposing financial consequences for entities that fail to meet the targets. [v]

Increasing Access to Safe, Equitable Reproductive Health Care: The May Revision includes $57 million GF to maintain and improve reproductive health care. Proposals include:

- Uncompensated Care Funding: One-time, $40 million GF over six years for HCAI to award grants to reproductive health care providers to offset the cost of providing care to low- and middle-income individuals without coverage for abortion care services.

- California Reproductive Justice and Freedom Fund: One-time, $15 million GF for the California Department of Public Health (CDPH) to award grants to community-based reproductive health, rights, and justice organizations for outreach and education activities.

- Comprehensive Reproductive Rights Website and Research on Unmet Needs: One-time, $2 million GF for CDPH to develop and maintain a public website on the right to abortion care under state law, information about providers, and coverage options for reproductive services, including state-funded coverage and programs, and to conduct research on barriers for accessing reproductive health care services. [iii]

2. Fiscal Outlook for the Medi-Cal Program

The state’s Medicaid program, Medi-Cal, is administered by the Department of Health Care Services (DHCS). The Governor’s proposed budget includes Medi-Cal expenditures of $121.9 billion TF ($25.1 billion GF) in FY 2021-22 and $135.5 billion TF ($36.6 billion GF) in FY 2022-23. The proposed budget assumes that the caseload will increase by approximately 6.6 percent from FY 2020-21 to FY 2021-22 and 0.6 percent from FY 2021-22 to FY 2022-23, covering about 14.5 million Californians in FY 2022-23. [iv]

COVID-19 Impacts on Medi-Cal Caseload: The budget assumes the public health emergency (PHE) will remain in effect until at least June 2022. Subsequently, and coupled with the continuous coverage requirement of the federal Families First Coronavirus Response Act (FFCRA), the budget assumes the Medi-Cal caseload will continue to grow and will peak at 15.2 million in July 2022. The associated costs of the growing caseload are $10.4 billion total funds ($2.9 billion GF) in FY 2021-22 and $10 billion ($2.8 billion GF) in FY 2022-23. [iv]

Increased Federal Medical Assistance Percentage (FMAP): Increased federal FMAP funding, 6.2 percent raising California’s FMAP to 56.2 percent [vi], is available an additional quarter, until September 2022, from what was assumed in the January Budget. The May Revision reflects $5.4 billion in increased FMAP funding and related GF savings of $3.5 billion in FY 2021-22, and $2.1 billion in increased FMAP funding and $1.3 billion GF savings in FY 2022-23. [iv] For more information on Medi-Cal funding and other Medi-Cal facts and data, see California Health Care Foundation’s 2021 Medi-Cal Facts and Figures publication.

Medi-Cal Caseloads and Post-PHE Redeterminations: Medi-Cal eligibility redeterminations are currently suspended until the extended end date of the PHE, July 2022. With this extension, the budget assumed redetermination activities will be initiated August 2022, with the first redeterminations completed October 2022, and individuals no longer eligible for Medi-Cal will exit the program in November 2022. Based on this updated timeline, the May Revision includes costs of $8.8 billion TF ($2.5 billion GF) in FY 2021-22 and $9.9 billion TF ($2.8 billion GF) in FY 2022-23, representing a GF saving of $487 in FY 2021-22 and $27 million in FY 2022-23 from the January proposed budget. [iv]

Supporting Redeterminations and Enrollment Outreach in Medi-Cal: One of the flexibilities under the PHE was a continuous coverage requirement that is set to end with the PHE (currently slated for July 15, 2022). Once the PHE ends, California will have up to 14 months to initiate and complete redeterminations for currently enrolled Medi-Cal members. The May Revision includes $146 million ($73 million GF) over two fiscal years to support Medi-Cal redetermination efforts. The proposed proposals include:

- Health Enrollment Navigators Project: $60 million TF ($30 million GF), would be available over four years, to continue the Health Enrollment Navigators Project. Among other things, Health Navigators will provide outreach and enrollment to support the rollout of the enacted and proposed Medi-Cal eligibility expansion efforts.

- Media and Outreach Campaign: $25 million ($12.5 million GF) proposal for media and outreach campaigns encouraging Medi-Cal members to update their contact information with their county offices and to educate members on eligibility once the PHE ends. [iii]

Transition of Proposition 56 Funded Payments to Ongoing General Fund: Declining Proposition 56 revenues have led to insufficient funds to support current Proposition 56 payments starting in FY 2022-23. The May Revision, beginning in FY 2022-23, proposes to fully transition nine of the Proposition 56 payments, valued at $147 million, to ongoing rate increases supported by the GF. The May Revision also includes an additional $295 million GF in FY 2022-23 for Proposition 56 payments. [iv]

Elimination of Certain AB 97 Provider Rate Reductions: AB 97 (Chapter 3, Statutes Of 2011) required DHCS to reduce most Medi-Cal provider payments by 10 percent. Since that time, certain AB 97 provider payment reductions have been rescinded. The January budget proposal included eight provider types and the May Revision proposes trailer bill language that clarifies that seven additional benefits are not subject to the AB 97 rate reductions including doula services, community health worker services, continuous glucose monitoring system, supplies, and accessories, remote patient monitoring health care services, asthma prevention services, dyadic services, and medication therapy management. The estimated costs of these eliminations are revised to $9.6 million TF ($4 million GF) in FY 2022-23 and $11.2 million TF ($4.7 million GF) ongoing for the elimination of these rate reductions (there is no cost impact to exempting the seven additional benefits as they were budgeted to always assume to have no AB 97 rate reductions applied to them). [iv]

Continuous Glucose Monitoring (CGM) Reimbursement Methodology Update: In the May Revision, DHCS proposed, effective July 1, 2022, to amend the definition of medical supplies under the pharmacy benefit to include products for treating diabetes. The revised estimate cost for CGM with these changes are $6.1 million TF ($2.2 million GF) in FY 2021-22 and $9.7 million TF ($3.5 million GF) in FY 2022-23. [iv]

3. Budget Proposals Impacting Delivery System Transformation

California Advancing and Innovating Medi-Cal (CalAIM): The May Revision includes $1.1 billion TF ($459 million GF) in FY 2021-22 and $3.1 billion TF ($1.2 billion GF) in FY 2022-23. [iv] For more information on CalAIM, implementation timelines, and quick links to CalAIM resources see ITUP’s CalAIM Summary and Timeline Fact Sheet.

Providing Access and Transforming Health (PATH): Enhanced Care Management, Community Supports, and Justice-Involved Re-Entry: The proposed budget reflects the expanded scope of activities through PATH as approved in DHCS’s 1115 waiver that was finalized and approved by the federal Centers for Medicare and Medicaid Services in December 2021. The proposed budget includes:

- $1.3 billion TF over five years to support the development and Enhanced Care Management (ECM) and Community Supports in CalAIM, and,

- $561 million TF over five years to support the implementation of CalAIM justice-involved initiatives. [iii]

Doula Benefit Update: The May Revision proposes to increase the maximum reimbursement rate per birth for doula services in Medi-Cal from $450 to $1,094 and shifts the implementation of this benefit from July 2022 to January 2023, an estimated annual cost of $10.8 million ($4.2 million GF). [iv]

Retention Payments for Hospital and Nursing Facility Workforce: The May Revision includes $933 million one-time funding to provide retention payments for workers in hospitals, skilled nursing facilities, and psychiatric hospitals. This funding is estimated to reach 600,000 California health care workers in health care jobs most impacted by the COVID-19 pandemic. [iii]

CalHOPE Funding Update: CalHOPE, a program administered by DHCS, delivers crisis and counseling support to help people recover from disasters, including the COVID-19 pandemic. The current funding of CalHOPE, through Federal Emergency Management Agency (FEMA) expires May 2022. The May Revision proposes $10.9 million GF in FY 2021-22, $80 million GF in FY 2022-23, and $40 million GF in FY 2023-24 to support the program through December 2023. [iii]

Children and Youth Behavioral Health Initiative: In FY 2022-23, the January budget proposed $1.1 billion total funds to advance the Children and Youth Behavioral Health Initiative (CYBHI), which was launched in 2021. This proposal includes funds for implementing dyadic services, evidence-based behavioral health practices, and school behavioral health partnerships and capacity building. [v] The May Revision makes updates to the CYBHI including:

- Student Behavioral Health Incentive Program: $20 million TF ($10 million GF) in FY 2021-22 to increase access to student behavioral health services. This new estimate reflects a reduction of $45 million TF ($23 million GF) compared to the January budget proposal. In FY 2022-23, the May Revision includes an increase in funding for this proposal to $194 million TF ($97 million GF) and increase of $65 million TF ($32 million GF).

- School Behavioral Health Partnerships and Capacity: The May Revision assumes that the $100 million GF appropriation from the FY 2021-22 Budget Act will shift to FY 2023-24.

- CalHOPE Student Support: About $3 million GF previously assumed to be spent in FY 2021-22 is shifted to FY 2022-23. [iv]

Addressing Behavioral Health Needs in Children and Youth: The May Revision includes $290 million GF in one-time proposals to address the youth mental health crisis exacerbated by the COVID-19 pandemic and support wellness and behavioral resilience in children, youth, and families. [iii]

4. Proposals Advancing Health Equity and Social Determinants of Health

Transportation Rebates: With inflation rates higher than they have been in over 40 years, the price of many consumer goods has increased—especially the cost of gas, which for much of the state reached well over $5 per gallon in 2022 and has greatly affected many Californians. The May Revision includes a one-time refund of $400 to each eligible owner of a registered vehicle, up to two vehicles per person (maximum of $800 rebate per person). These rebates would return an estimated $11.5 billion back to taxpayers. [vii]

Equity and Practice Transformation Payments: In addition to the $400 million ($200 million GF) included in the January budget proposal, the May Revision proposes an additional $300 million ($150 million GF), available over five years, for equity and practice transformation payments to qualifying Medi-Cal providers with the goals of closing equity gaps, addressing gaps in preventative, maternity, and behavioral health care measures, and gaps in care due to the COVID-19 pandemic. The additional funding proposed further supports early childhood-focused efforts ($100 million ($50 million GF)) and technical assistance for small practice physicians to upgrade their infrastructure, systems, and capacity ($200 million ($100 million GF)). [iii]

Supporting Aging Well for California Seniors: The May Revision builds upon the proposals in the January budget proposal to support California’s aging population. These investments propose support for aging and community living and further the goal of advancing inclusive, equitable communities for individuals of all ages and abilities. The May Revision includes:

- Community Living Fund: One-time, $10 million GF available for three years for this fund to assist non-Medi-Cal eligible older adults and persons with disabilities, including those transitioning from nursing homes to independent living.

- Home and Community-Based Services (HCBS) Infrastructure Planning and Development: One–time, $4 million GF to develop a statewide roadmap for the Department of Aging, in partnership with DHCS, to support the development of home and community-based services for individuals in underserved areas, regardless of income.

- Caregiver Resource Center: $545,000 in additional ongoing GF for statewide training and technical assistance for resource centers that provide critical services to family caregivers. This funding is in addition to $14.9 million transfer from DHCS to the Department of Aging to oversee this program.

- Long-Term Care Ombudsman Outreach Program: $3.5 million one-time GF to support a Long-Term Care Ombudsman outreach campaign to raise awareness of the resources available to residents and families in skilled nursing, assisted living, and other residential facilities.

- Aging and Disability Institute of Learning and Innovation: $682,000 ongoing GF to establish the Aging and Disability Institute of Learning and Innovation, tasked with developing a comprehensive adult learning management system, content and training to improve quality, efficiency, and access to services for older adults and people with disabilities.

- Emergency Preparedness and Response: $400,000 ongoing GF to develop strategies, tools, and resources to help older adults, individuals with disabilities, family caregivers, and local partners prepare for and respond to state emergencies and natural disasters. [iii]

For more information on Medicare eligibility, dual eligibles, benefits, and enrollment in California, as well as programs to address the social determinants of health for California’s seniors, see ITUP’s “Medicare and Health for Aging Californians” fact sheet.

Community Assistance, Recovery, and Empowerment (CARE) Court: CARE Court is a new court process to deliver community-based behavioral health services and supports to Californians living with severe, untreated psychotic disorders. The May Revision includes over $100 million GF to administer the CARE Court program. [iii]

Office of Community Partnerships and Strategic Communications: The May Revision includes an additional $230 million for this office, proposed in the January budget proposal [v], to be created in the Governor’s Office of Planning and Research [viii], to support COVID-19 vaccine-related public education and outreach that was previously implemented by the California Department of Public Health (CDPH). [iii]

Expanding Home Visiting Services: Unchanged from the January budget proposal, the budget proposes $50 million ongoing GF for CDPH to expand the California Home Visiting Program and the California Black Infant Health Program. This proposal will expand services for approximately 6,000 additional families over five years. [v]

In-Home Supportive Services (IHSS): The May Revision includes $19 billion ($6.5 billion GF) for the IHSS program in FY 2022-23, with an estimated monthly caseload of 601,000 in 2022-23. The May Revision also includes $34.4 million ($15.4 million GF) ongoing to establish a permanent backup provider system for IHSS recipients to avoid disruptions to caregiving due to immediate needs or emergencies. The permanent system will be implemented in October 2022. [iii]

5. Budget Proposals to Advance the Future of Health

Broadband Middle Mile: The May Revision includes an additional, one-time $1.1 billion ($600 million GF in FY 2023-24 and $500 million GF in FY 2024-25) to support the completion of the Broadband Middle-Mile Initiative. This funding builds upon the $3.25 billion investments in the 2021 Budget Act to build an open-access, state-owned middle-mile broadband network. [iii] For more information on broadband and connectivity and how the digital divide impacts health, see ITUP’s Broadband for Health Fact Sheet and How to Engage Presentation.

Public Health Funding: The May Revision includes an additional $1.1 billion to implement California’s SMARTER plan to continue addressing the evolving conditions of the COVID-19 virus and allow the state to be prepared to mitigate the effects of the ongoing public health concern in the future. This funding includes proposals for staffing, testing, vaccinations, future therapeutics, and more. [iii]

Data Exchange Framework (Framework): In accordance with Chapter 143, Statutes of 2021 (AB 133), the Framework, a single data-sharing agreement and common set of policies to govern the exchange of health and human services information, is set to begin July 2022. The May Revision includes a two-year, $50 million grant program to provide technical assistance to small or under-resourced providers, particularly small physician practices, rural hospitals, and community-based organizations that are new to health information exchange. [iii]

Climate Health Proposals: In addition to the investments made in the January budget proposal relating to the public health impacts of climate change, the May Revision includes $43 million to address extreme heat protections for vulnerable populations. [x]

Budget Process: What’s Next

A Balanced Budget: The Legislature is required to produce a “balanced budget” and send it to the Governor by Wednesday, June 15, 2022. Due to the requirement that a bill be in print for at least 72 hours prior to legislative action, watch for the budget bill to be in print by Monday, June 13, 2022, so that it can be sent to the Governor on Wednesday, June 15, 2022. The Budget Bill requires a majority vote from both houses of the Legislature to be advanced to the Governor for enactment.

Final Budget Enactment: After the budget bill passes through the Legislature, the Governor then has 15 days to sign it into law by the start of the new fiscal year, which begins July 1, 2022.

“Budget Bill Junior” and Trailer Bills:

- While there is a requirement that the Legislature sends the main budget bill to the Governor for signature by June 15, the Legislature also typically uses additional policy-area-specific bills called “trailer bills” to provide additional details around the expenditures contained in the budget bill.

- These bills do not need to be sent to the Governor by June 15 and may be passed throughout the summer and before the Legislative Session ends in mid-September.

- Similarly, the Legislature may choose to revise the main budget bill with a “budget bill junior” before the Legislative Session ends in mid-September.

Key Government Resources

Below, we’ve provided key places to find both summary level and detailed information on the state budget, as well as links to budget bill language (BBL), trailer bill language (TBL), and budget change proposals (BCPs).

Administration/Executive Branch Resources:

A. Governor’s Budget/Department of Finance (DOF): This is the official page for the Governor’s Budget, which includes both detailed fiscal information (“budget detail”) and summary level information (also known as “summary” or “A Pages”), and is updated at the January Budget Release, May Revision, and upon signature of the Final Budget Act; you can also find past budgets here.

B. Administration/DOF Health and Human Services Budget Summary: This is the summary for the Health and Human Services programs in the budget. There are also summary charts for the entire budget, as well as a few topic-specific summary chapters, such as Homelessness and Labor and Workforce Development, that may be tangentially related to Health and Human Services. Note: there is much more detail in individual departments’ budgets, see the links provided below, than is summarized here.

C. Department-Specific Highlights: Some departments release a “highlights” document that delves further into their department-specific budget proposals and changes.

a. Department of Health Care Services (DHCS) Budget Highlights

b. California Department of Public Health (CDPH) Budget Highlights

c. California Department of Social Services (CDSS) Local Assistance Summary Highlights

D. Proposed Trailer Bill Language (TBL)

E. Proposed Budget Change Proposals (BCPs)

Legislative Resources:

A. Legislative Analyst’s Office (LAO) 2022-23 Budget: California’s Fiscal Outlook

B. Assembly Committee on Budget

a. Highlights of the Governor’s Proposed Budget 2022-23

b. Subcommittee #1 on Health and Human Services

C. Senate Committee on Budget and Fiscal Review

a. Summary of the Governor’s Proposed Budget 2022-23

b. Subcommittee #3 on Health and Human Services

D. Proposed Budget Bill Language (BBL): TBD

Stay tuned for our next update on the Final Budget Act!

[i] Ben Christopher, California’s $100 Billion Surplus: What to Know About Newsom’s Spending Plan, CalMatters, May 13, 2022.

[ii] Legislative Analyst’s Office, Strong Tax Collections Belie California’s Challenging Fiscal Outlook, April 26, 2022.

[iii] Department of Finance (DOF), May Revision, Health and Human Services Budget Summary, May 13, 2022.

[iv] Department of Health Care Services (DHCS), 2022-23 Governor’s May Revision DHCS Highlights, May 13, 2022.

[v] ITUP Blog, Governor’s FY 2022-23 Budget Proposal: Key Highlights, January 20, 2022.

[vi] H.R. 6201, Families First Coronavirus Response Act, August 2020.

[vii] DOF, May Revision, Broad-Based Relief, May 13, 2020.

[viii] Governor’s Office of Planning and Research, Press Release, Governor Newsom Proposes New Office of Community Partnerships and Strategic Communications as part of California Blueprint, January 10, 2022.

[x] DOF, May Revision, Climate Change, May 13, 2020.