ITUP Blog: Governor’s FY 2022-23 Budget Proposal: Key Highlights

Governor’s Fiscal Year 2022-23 Budget Proposal

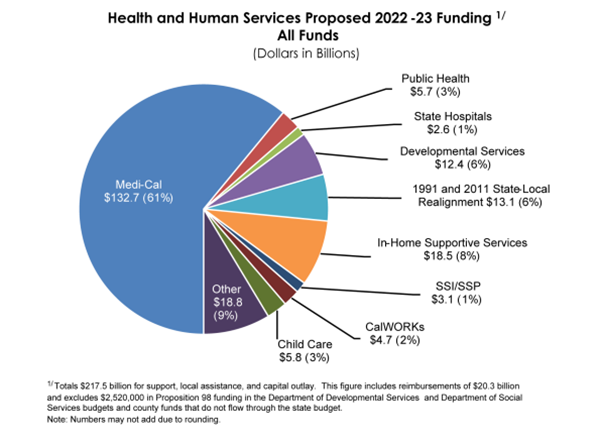

On January 10, 2022, Governor Gavin Newsom released his Fiscal Year (FY) 2022-23 Budget proposal of $286 billion total funds (TF) ($213 billion General Fund (GF)). Health and Human Services makes up a large portion of the budget with proposed expenditures of $217.5 billion TF ($64.7 billion GF and $152.7 billion other funds (OF)). [i] The proposed budget, which was released amid a surge of COVID-19 cases, includes a surplus of $45.7 billion, $20.6 billion of which is intended for discretionary purposes. The FY 2022-23 proposed budget prioritizes a commitment to reaching universal health coverage, addressing health disparities across California communities, augmenting the health care workforce, and transforming the health care delivery system to deliver health care when, where, and how Californians need it.

With the rising costs of public services over the past few years, and in the wake of the COVID-19 pandemic, the Gann Limit, known as the State Appropriations Limit, is a spending cap that limits growth of the State’s annual budget. To read more about impacts of the Gann Limit on California’s budgets, see the Legislative Analyst Office FY 2022-23 Budget Outlook Report and the California Budget and Policy Report. The Governor noted that his May Revision of the budget will include updated projections and proposals to address the possibility of exceeding the Gann Limit.

This blog highlights key health and human services proposals in the FY 2022-23 proposed budget as well as proposals that improve health equity and address the social determinants of health. Following the summary of key budget highlights, we discuss what to expect during the months between now and the May Revision, when the Governor will release a revised budget before it ultimately is signed into law this summer. We also include links to resources on where to find budget change proposals, trailer bill language, department-specific budget highlights, and more.

Key FY 2022 – 23 Proposed Budget Highlights

1. Budget Proposals Advancing Coverage and Access

Expansion of Full-Scope Medi-Cal Coverage to All Adults Regardless of Immigration Status: Building upon Medi-Cal expansion efforts in the Affordable Care Act and over the past few years, the FY 2022-23 budget proposes, no sooner than January 1, 2024, to extend Medi-Cal coverage to adults aged 26 through 49 years, regardless of immigration status. This expansion would cover an estimated 700,000 Californians and is anticipated to costs $819 million TF ($614 million GF) in FY 2023-24 and $2.3 billion TF ($1.8 billion GF) at full implementation.[ii][iii] See ITUP’s “Who are the Remaining Uninsured?” Fact Sheet for more information about who this proposal impacts.

Reducing Medi-Cal Premiums to Zero: The budget proposes $53 million TF ($19 million GF) in FY 2022-23 and $89 million ($31 million GF) ongoing to reduce premiums to zero for programs under the Children’s Health Insurance Program (CHIP) and the 250 Percent of the Federal Poverty Level Working Disabled Program. [iii]

Covered California Subsidies and Affordability: In 2021, the federal American Rescue Plan Act (ARP) expanded federal marketplace health insurance subsidies through 2022, which took the place of state-funded subsidies for low- and middle-income consumers not eligible for federal subsidies. The GF dollars saved from the ARP last year totaled $333.4 million and was required by the Legislature [iv] [v] to be placed into reserves and used for future affordability programs. [ii] In January 2022, Covered California released a report “Bringing Care Within Reach” highlighting options for spending these funds.

Office of Health Care Affordability: The budget proposal includes $30 million GF to create the Office of Health Care Affordability within the Department of Health Care Access and Information (HCAI) with the intent of increasing price transparency, developing specific cost targets for different sectors of the health care industry, and imposing financial consequences for entities failing to meet the targets. [ii]

2. Fiscal Outlook for Medi-Cal Program

The state’s Medicaid program, Medi-Cal, is administered by the Department of Health Care Services (DHCS). The Governor’s proposed budget includes Medi-Cal expenditures of $123.8 billion TF ($26.8 billion GF) in FY 2021-22 and $132.7 billion TF ($34.9 billion GF) in FY 2022-23. The proposed budget assumes that caseload will increase by approximately 8.3 percent from FY 2020-21 to FY 2021-22 and decrease by 3 percent from FY 2021-22 to FY 2022-23, covering about 14.2 million Californians in FY 2022-23. [iii]

COVID-19 Impacts on Medi-Cal Caseload: The budget assumes that the public health emergency (PHE) will remain in effect until at least June 2022. Subsequently, and coupled with the continuous coverage requirement of the federal Families First Coronavirus Response Act (FFCRA), the budget assumes that the Medi-Cal caseload will continue to grow and will peak at 15.2 million in July 2022. The associated costs of the growing caseload are $10.4 billion total funds ($2.9 billion GF) in FY 2021-22 and $10 billion ($2.8 billion GF) in FY 2022-23. [iii]

Post-Public Health Emergency Medi-Cal Eligibility Redeterminations: The proposed budget includes $73 million TF ($37 million GF) in both FY 2021-22 and FY 2022-23 to support the county workload associated with redetermining eligibility for individuals that remained enrolled in Medi-Cal due to the continuous coverage requirement of the FFCRA. [iii]

Transition of Proposition 56 Funded Payments to Ongoing General Fund: Declining Proposition 56 revenues have led to insufficient funds to support current Proposition 56 payments starting in FY 2022-23. The budget, beginning in FY 2022-23, proposes to fully transition nine of the Proposition 56 payments, valued at $147 million, to ongoing rate increases supported by the GF. [iii]

Elimination of Certain AB 97 Provider Rate Reductions: AB 97 (Chapter 3, Statutes Of 2011) required DHCS to reduce most Medi-Cal provider payments by 10 percent. Since that time, certain AB 97 provider payment reductions have been rescinded. The budget proposes to rescind the AB 97 provider rate reductions for eight provider types based on COVID-19 Pandemic impacts and the Department’s quality and equity goals—nurses of all types, alternative birthing centers, audiologists and hearing aid dispensers, respiratory care providers, select durable medical equipment providers, chronic dialysis clinics, non-emergency medical transportation providers, and emergency medical air transportation providers. The Budget includes fee-for-service costs of $20.2 million ($9 million General Fund) in 2022-23 and $24 million ($10.7 million General Fund) annually thereafter for elimination of these rate reductions. [ii]

3. Budget Proposals Impacting Delivery System Transformation

California Advancing and Innovating Medi-Cal (CalAIM): The proposed budget includes $1.2 billion TF ($435.5 million GF) in FY 2021-22, $2.8 billion TF ($982.6 million GF) in FY 2022-23, $2.4 billion TF ($876.4 million GF) in FY 2023-24, and $1.6 billion TF ($500 million GF) in FY 2024-25 for CalAIM. [ii] To read more about the CalAIM initiatives being implemented in FY 2022-23 and subsequent years, read ITUP’s publication, CalAIM Summary and Timeline.

Providing Access and Transforming Health (PATH): Enhanced Care Management, Community Supports, and Justice-Involved Re-Entry: The proposed budget reflects the expanded scope of activities through PATH as approved in DHCS’s 1115 waiver that was finalized and approved by the federal Centers for Medicare and Medicaid Services in December 2021. The proposed budget includes:

- $1.3 billion TF over five years to support the development and Enhanced Care Management (ECM) and Community Supports in CalAIM, and,

- $561 million TF over five years to support the implementation of CalAIM justice-involved initiatives. [iii]

Additional Initiatives to Support Justice-Involved Californians: The budget proposes $50 million TF ($16 million GF) in FY 2022-23 to implement CalAIM justice-related initiatives which include resources to support capacity-building, technical assistance, collaboration, and planning by county and corrections entities to provide pre-release applications, pre-release in-reach services, and coordinated re-entry. [iii]

Children and Youth Behavioral Health Initiative: In FY 2022-23, the budget proposes $1.1 billion total funds to advance the Children and Youth Behavioral Health Initiative that was launched in 2021. This proposal includes funds for implementing dyadic services, evidence-based behavioral health practices, and school behavioral health partnerships and capacity building. [iii]

Medi-Cal Community-Based Mobile Crisis Services: Starting as soon as January 1, 2023, the budget proposes $108 million total funds ($16 million GF) to add qualifying community-based mobile crisis intervention services as a mandatory Medi-Cal benefit available to Medi-Cal members. [iii]

Public Hospital Financing Reform: To further the standardization of the Medi-Cal program and move towards a more streamlined financing system, the Administration proposes to work with the public hospital systems in FY 2022-23 to reform Medi-Cal payments for public hospitals to provide person-centered care, reduce administrative burden, and focus on integration, quality, outcomes, and value. [ii]

Expanding the Care Economy Workforce: The budget proposes $1.7 billion over three years for HCAI to develop a diverse, culturally competent, and equitable care economy workforce. [i] Summaries of some of the proposed workforce investments are listed below, to see the full list, see the Labor and Workforce Development summary of the budget.

-

- Community Health Workers (CHWs): The budget proposes $350 million GF to recruit, train, and certify 25,000 new CHWs by 2025. CHWs made a significant impact on the hardest-hit communities throughout the COVID-19 pandemic. See ITUP’s publication Community Health Workers and the Health Care Delivery System for more information on CHWs and their critical role in the health care delivery system.

-

- Increasing Language and Cultural Diversity in Health Care: The budget proposes $130 million one-time Proposition 98 GF to support health care focused pathways for English Language Learner Californians and $60 million GF to expand scholarships and loan repayment programs for multilingual health care and social work students. These proposals create a pathway to increase language and cultural diversity in health care settings, which is key to creating a health care system that serves diverse communities across the state.

-

- Psychiatric Resident Program: The budget includes $120 million GF to create more training positions for psychiatric residents, psychiatric mental health nurse practitioners, psychology interns/fellows, and psychiatric nurses.

-

- Clinical Infrastructure for Reproductive Health: The budget includes $20 million one-time GF to support scholarships and loan repayments to health care providers who commit to providing reproductive care services.

Community Benefit Funding for Community-Based Organizations (CBOs): The budget proposes statutory changes to direct 25 percent of non-profit hospitals’ community benefit dollars to CBOs and gives HCAI enforcement authority over these requirements. CBOs have a key role in the health care delivery system in addressing the social determinants of health by bringing skills, perspectives, and trusted community relationships that can be leveraged to create a health care system that is more patient-centered and improves the health of Californians from all communities. [ii]

4. Proposals Advancing Health Equity and Social Determinants of Health

Office of Community Partnerships and Strategic Communications: The budget includes $65 million ongoing GF dollars to create the Office of Community Partnerships and Strategic Communications, which will work with CBOs and other community partners statewide to engage Californians experiencing health and social inequities with culturally competent and relevant information to improve the lives among California’s communities. [i]

Equity and Practice Transformation Payments: The budget proposes to make equity and practice transformation payments to qualifying Medi-Cal providers with the goals of closing equity gaps, addressing gaps in preventative, maternity, and behavioral health care measures, and gaps in care due to the COVID-19 pandemic. The budget proposes $400 million TF ($200 million GF) in one-time funding to support these transformation payments. [iii]

Supporting Aging Well for California Seniors: The following proposals are included in the FY 2022-23 budget proposal as investments to support California’s aging population. [ii] For more information on Medicare eligibility, benefits, and enrollment in California, as well as programs to address the social determinants of health for California’s seniors, see ITUP’s “Medicare and Health for Aging Californians” fact sheet.

-

- In-Home Supportive Services (IHSS): The proposed budget includes $18.5 billion TF ($6.5 billion GF) for the IHSS program in FY 2022-23. The IHSS program provides services such as housework, meal preparation, and personal care services to eligible individuals with disabilities, including seniors. The proposed budget estimates that this program has an average monthly caseload of 599,000 in FY 2022-23, and helps low-income Californians remain in their homes, rather than in costly institutions.

- Cognitive Health Assessments: Starting July 1, 2022, the proposed budget includes $341,000 TF ($171,000 GF) to make an annual cognitive assessment a covered benefit to Medi-Cal members who are aged 65 years or older if they are otherwise ineligible for a similar annual wellness visit under Medicare. [iii]

- Master Plan for Aging: The budget proposes to include $2.1 million ($1.8 million GF) for the Master Plan for Aging Data Dashboard.

- Protecting and Empowering At-Risk Aging and Disabled Populations: The proposed budget includes $10.6 million GF annually for three years to continue the Returning Home Well Program.

Indian Health Program Grant Restoration: The budget proposes $12 million GF in FY 2022-23 to restore local assistance grant funding for 45 Tribal and urban Indian health clinics. [iii] This funding would also be used, in part, to promote the retention of the health care workforce that serves these programs. [ii]

Expanding Home Visiting Services: The budget proposes $50 million ongoing GF for the California Department of Public Health (CDPH) to expand the California Home Visiting Program and the California Black Infant Health Program. This proposal will expand services for approximately 6,000 additional families over five years. [ii]

Housing Supports to Individuals with Behavioral Health Needs: The budget proposal includes $1.5 billion GF over two years that will be administered by DHCS’ Behavioral Health Continuum Infrastructure Program for resources to address immediate housing and treatment needs. These supports include tiny homes and/or other bridge housing settings. [vi]

Expanding Access to Food: The budget proposal includes $35.2 million GF for planning, and $113.4 million GF annually in FY 2025-26 to expand the California Food Assistance Program (CFAP) to Californians aged 55 years and older regardless of immigration status. [ii]

5. Budget Proposal to Advance the Future of Public Health

Public Health Funding: The budget proposal includes $5.7 billion TF ($1.7 billion GF) in FY 2022-23 for CDPH. [ii] Within this proposal, $300 million GF is allocated for CDPH ($100 million GF) and local health jurisdictions ($200 million GF) to permanently expand the state’s ability to protect public health and address the social determinants of health. [ii]

Supporting Public Health IT Systems: The budget proposal includes 130 positions and $235.2 million GF in FY 2022-23, 140 positions and $156.1 million GF in FY 2023-24, and 140 positions and $61.8 million GF in FY 2024-25 and ongoing to CDPH to maintain and operate IT platforms and applications stood up during the COVID-19 Pandemic and that are required to support public health services statewide.

Climate Health Proposals: To address the disproportionate public health impacts from climate change, the budget proposal includes several investments to integrate health and equity into California’s climate change agenda. [vii] Proposals include, but are not limited to:

-

- $25 million one-time GF for a grant program for local health jurisdictions to develop regional Climate and Health Resilience Plans;

- Approximately $175 million GF in FY 2022-23 to mitigate the impacts of extreme heat (example: nature-based solutions and urban greening); and,

- $10 million ongoing GF to establish a monitoring program to track emerging or intensified climate-sensitive health impacts and diseases.

Budget Process: What’s Next Between Now and May Revision

Legislative Budget Hearings: Between now and the release of the May Revision in mid-May, the Legislature’s Senate and Assembly Budget Committees and their policy-specific sub-committees will invite the Department of Finance and State Departments to present the Governor’s January Budget to those committees. They will also allow for stakeholders to provide public comment on the Governor’s proposals as well as present their own “stakeholder proposals”. In most cases, these committees will not take any action on the Governor’s budget proposals or on the stakeholder proposals and will instead “hold them open” until after the May Revision is released.

May Revision: The Governor, in mid-May, will release a revised budget and fiscal outlook. At this time, the Legislature’s Budget subcommittees and Full Budget committees will meet and either approve or reject the Governor’s and stakeholders’ proposals. The Legislature and the Governor will then negotiate to produce a final budget.

A Balanced Budget: The Legislature is required to produce a “balanced budget” and send it to the Governor by Wednesday, June 15, 2022. Due to the requirement that a bill be in print for at least 72 hours prior to legislative action, watch for the budget bill to be in print by Monday, June 13, 2022, so that it can be sent to the Governor on Wednesday, June 15, 2022. The Budget Bill requires a majority vote of both houses of the Legislature to be advanced to the Governor.

Final Budget Enactment: After the budget bill passes through the Legislature, the Governor then has 15 days to sign it so that it will be law by Friday, July 1, 2022, the start of the new fiscal year. Additional bills called “trailer bills” that make statutory changes needed to implement the spending items in the Budget Bill will also move through the Legislative process and be signed by the Governor, although they do not have to be sent to the Governor by June 15.

Key Government Resources

Below, we’ve provided key places to find both summary level and detailed information on the state budget, as well as links to budget bill language (BBL), trailer bill language (TBL), and budget change proposals (BCPs).

Administration/Executive Branch Resources:

- Governor’s Budget/Department of Finance (DOF): This is the official page for the Governor’s Budget, includes both detailed fiscal information (“budget detail”) and summary level information (also known as “summary” or “A Pages”), and is updated at the January Budget Release, May Revision, and upon signature of the Final Budget Act; you can also find past budgets here.

- Administration/DOF Health and Human Services Budget Summary: This is the summary for the Health and Human Services programs in the budget. There are also summary charts for the entire budget, as well as some topic-specific summary chapters, such as Homelessness and Labor and Workforce Development, that may be tangentially related to Health and Human Services. Note: there is much more detail in individual departments’ budgets, see the links provided below, than is summarized here.

- Department-Specific Highlights: Some departments release a “highlights” document that delves further into their department-specific budget proposals and changes.

- Department of Health Care Services (DHCS) Budget Highlights

- California Department of Public Health (CDPH) Budget Highlights

- California Department of Social Services (CDSS) Local Assistance Summary Highlights

4. Proposed Trailer Bill Language (TBL)

5. Proposed Budget Change Proposals (BCPs)

Legislative Resources:

- Legislative Analyst’s Office (LAO) 2022-23 Budget: California’s Fiscal Outlook

- Assembly Committee on Budget

- Senate Committee on Budget and Fiscal Review

- Proposed Budget Bill Language (BBL): TBD

Stay tuned for our next update at the May Revision!

[i] Department of Finance (DOF), Governor’s Proposed Budget Summary FY 2022-23, January 2022.

[ii] DOF, Governor’s Proposal Budget FY 2022-23 Health and Human Services Summary, January 2022.

[iii] Department of Health Care Services, FY 2022-23 DHCS Budget Highlights, January 2022.

[iv] Health Budget Trailer Bill, AB 133, Chapter 143, Statutes of 2021.

[v] Health Budget Trailer Bill, AB 128, Chapter 21, Statutes of 2021.

[vi] DOF, Governor’s Proposed Budget FY 2022-23 Housing and Homelessness Summary, January 2022.

[vii] DOF, Governor’s Proposed Budget FY 2022-23 Climate Change Summary, January 2022.