ITUP Blog: Governor’s FY 2023-24 Budget: Key Highlights in the May Revision

Governor’s FY 2023-24 Budget: Key Highlights in the May Revision

Governor’s Fiscal Year 2023-24 Budget May Revision: Maintaining Health Care Spending Despite Increasing Budget Shortfall

On May 12, 2023, Governor Newsom released the May Revision of the Fiscal Year (FY) 2023-24 budget. The revised total budget for FY 2023-24 is $306.5 billion total funds (TF) ($224.1 billion General Fund (GF), $79.5 billion Special Funds, and $2.9 billion from bond funds). Following several years of budget surpluses, the January FY 2023-24 budget proposal projected a $22.5 billion budget shortfall or deficit, and the revised budget now predicts an additional $9 billion shortfall—resulting in a total budget deficit of $31.5 billion. [i] California took in fewer capital gains taxes by April 15 than expected, and due to natural disasters, tax returns are not due until October resulting in uncertainty in the final budget. [i]

This publication highlights key health and human services proposals in the FY 2023-24 May Revision. Following the summary of key budget highlights, we discuss what to expect in the coming months between now and the final budget, when the Governor will release a revised budget before it ultimately is signed into law this summer. We also include links to resources on where to find budget change proposals, trailer bill language, department-specific budget highlights, and more.

Key Highlights from the Governor’s FY 2023 – 24 May Revision

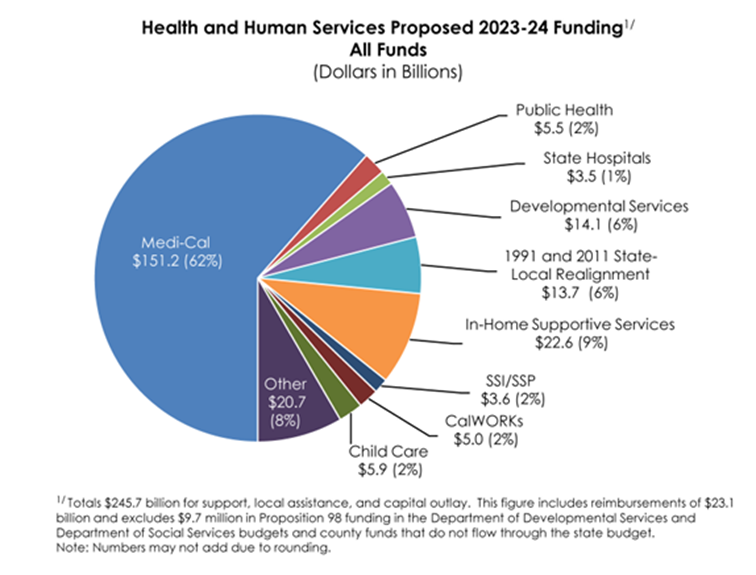

Below we highlight key health and human services proposals in the FY 2023-24 May Revision, as well as proposals that improve health equity and address the social determinants of health. Despite the expected shortfall, the May Revision included very few changes and/or reductions to the health care spending proposed in the January budget. The revised Health and Human Services budget is $245.7 billion ($73.3 billion GF and $172.4 billion other funds (OF)). [i] The breakdown of spending is shown in the figure below . [i] The proposals highlighted below represent a fraction of the proposals included in the May Revision.

1. Budget Proposals Advancing Coverage and Access

Medi-Cal Fiscal Outlook: The May Revision revises projected Medi-Cal enrollment from 14.4 million to 14.2 million. The revised Medi-Cal budget includes $135.4 billion ($30.9 billion GF) in FY 2022-23 and $151.2 billion ($37.6 billion GF) in FY 2023-24. This reflects an increase of $12.3 billion for FY 2023-24.[ii] Redeterminations for Medi-Cal eligibility began in April 2023 and will culminate in disenrollments for those no longer eligible or who cannot be recertified as eligible beginning this summer. Pending the outcome of redetermination efforts, it is estimated that the Medi-Cal caseload will fall to an estimated 12.8 million members.[ii]

Universal Coverage: The May Revision maintains the funding for Medi-Cal expansion to all income-eligible Californians, regardless of immigration status, including over $8 billion in various behavioral health investments and California Food Assistance Program (CFAP) implementation for income-eligible individuals, 55 years or older, regardless of immigration status by October 2025. [i] The May Revision also includes increases for the two recent expansions for adults 50 and older and ages 26-49 of $1.6 billion GF in 2023-24 and an estimated $2.4 billion GF annually.[ii]

Managed Care Organization (MCO) Tax: The MCO tax is a funding mechanism to draw down additional Medi-Cal matching funds to support the Medi-Cal program. The May Revision proposes an earlier start date of April 1, 2023, effective until December 31, 2026, to accelerate taxes on health plans to draw down additional federal funds totaling $19.4 billion GF. This increased investment in the GF aims to improve access, quality, and equity over eight to ten years. Approximately $11.1 billion in additional revenue from the MCO tax is proposed to be used to increase Medi-Cal rates to at least 87.5 percent of Medicare rates (approximately $237 million ($98 million GF) in FY 2023-24 and $580 million ($240 million GF) annually thereafter) for primary care, maternity care, and non-specialty mental health services, upon federal approval for a start date of January 1, 2024.[i][ii]

Covered California Health Care Affordability Reserves (HCARF): The May Revision maintains the proposal to move $333.4 million from Covered California reserves to the GF.[i] The law exerting penalties for not getting insurance has built up the Covered California reserves which are intended to be used to lower consumer costs (i.e., lower cost-sharing).[iii]

Home and Community-Based Services (HCBS) Spending Plan: The proposed budget of $2.8 billion for HCBS did not change; however, a six-month extension was added for specific programs (i.e., IHSS Career Pathways Program and the Senior Nutrition Infrastructure Program) to spend all funding based on critical programmatic needs by September 30, 2024. [i]

2. Budget Proposals Impacting Delivery System Transformation

California Advancing and Innovating Medi-Cal (CalAIM): The May Revision does not make any changes to the $10 billion TF proposal in the January budget.[ii] For more information on CalAIM, implementation timelines, and quick links to CalAIM resources see ITUP’s CalAIM Summary and Timeline Fact Sheet.

CalAIM Justice-Involved Initiative Medi-Cal Reimbursement System: The May Revision includes a one-time $3.3 million in FY 2023-24 ($200,000 GF, $3.1 million from reimbursement authority), $4.5 million in FY 2024-25, and $3.7 million FY 2025-26 for the California Correctional Health Care Services to create an information technology system to support the Medi-Cal billing process.[ii]

CalAIM Transitional Rent Waiver Amendment: Pending federal approval, the May Revision preserves the proposed $17.9 million ($6.3 million GF) for FY 2025-26 for six months of rent or temporary housing to eligible individuals experiencing homelessness or at risk of homelessness. Those eligible for this support, if offered by their Managed Care Plan (MCP), include individuals that are transitioning out of institutional levels of care, the justice system, or the foster care system, and those who are at risk of inpatient hospitalization or emergency department visits. [ii]

Health Care Workforce Investments: California will maintain $300 million GF to modernize public health infrastructure and continue to adopt a more resilient public health system, which includes expanding the public health workforce. The May Revision is also restoring $49.8 million (GF) over four years for public health workforce training and development programs.[i]

Behavioral Health Community-Based Organized Networks of Equitable Care and Treatment (BH-CONNECT) Demonstration: Pending federal approvals, the May Revision estimates $6.1 billion ($185 million General Fund, $87.5 million Mental Health Services Fund, $2.1 billion Medi-Cal County Behavioral Health Fund, and $3.6 billion federal funds) over five years to implement BH-CONNECT. BH-CONNECT would expand efforts to increase access to Medi-Cal behavioral health services no sooner than January 2024, particularly for children, youth, individuals at risk of or experiencing homelessness and justice-involved individuals.[ii]

Children and Youth Behavioral Health Initiative (CYBHI): The May Revision includes $10 million GF in FY 2023-24 to begin developing and implementing the statewide infrastructure to support school-based and school-linked providers under the CYBHI fee schedule.[ii]

Community Assistance, Recovery & Empowerment (CARE) Act: The May Revision includes increased allocations of $67.3 million GF in FY 2023-24, $121 million GF in FY 2024-25, and $151.5 million in 2025-26 and ongoing to support county behavioral health departments costs for the CARE Act. The May Revision also includes a $15 million one-time GF for Los Angeles County to start up funding for the December 1, 2023 implementation date.[i][ii]

Behavioral Health Bridge Housing Program: The May Revision eliminated the GF proposed delay of $250 million for this program, and instead, proposed to allocate $500 million from the Mental Health Services Fund in FY 2023-24. The May Revision also maintains the $1.5 billion augmentation allocated in the 2022 Budget Act for the program.[i]

3. Additional Highlighted Proposals

California Food Assistance Program (CFAP) Expansion Timing: The May Revision moves up the start date of CFAP benefits issuance from January 1, 2027, to October 2025, with automation beginning in July 2023. The May Revision includes $40 million to boost automation and outreach efforts.[i]

Impacts on Historic Broadband Investment: Last Mile Deferment: The 2021 Budget Act included $6 billion over three years as a statewide plan to expand broadband infrastructure, increase affordability, and enhance connectivity and broadband access. Also in the 2021 Budget Act, was a $2 billion allocation for the California Public Utilities Commission (CPUC) to facilitate last-mile projects across the state. The May Revision maintains the $550 million deferral of the CPUC last mile infrastructure grants in FY 2023-24 to $200 million in FY 2024-25, $200 million in 2025-26, and $150 million in FY 2026-27.[i]

Public Health Climate and Health Resilience Planning: The May Revision reduces the funding for climate and resilience planning to $25 million GF in FY 2022-23 and is pending fiscal outlooks to restore these reductions in following years.[i]

Public Health Workforce: The May Revision restores $49.8 million GF over four years to support public health workforce training and development programs.[i]

Budget Process: What’s Next

A Balanced Budget: The Legislature is required to produce a “balanced budget” and send it to the Governor by Thursday, June 15, 2023. Due to the requirement that a bill be in print for at least 72 hours before legislative action, watch for the budget bill to be in print by Tuesday, June 13, 2022, so that it can be sent to the Governor on Wednesday, June 15, 2022. The Budget Bill requires a majority vote from both houses of the Legislature to be advanced to the Governor for enactment.

Final Budget Enactment: After the budget bill passes through the Legislature, the Governor then has 15 days to sign it into law by the start of the new fiscal year, which begins July 1, 2023.

“Budget Bill Junior” and Trailer Bills:

- While there is a requirement that the Legislature sends the main budget bill to the Governor for signature by June 15, the Legislature also typically uses additional policy-area-specific bills called “trailer bills” to provide additional details about the expenditures contained in the budget bill.

- These bills do not need to be sent to the Governor by June 15 and may be passed throughout the summer and before the Legislative Session ends in mid-September.

- Similarly, the Legislature may choose to revise the main budget bill with a “budget bill junior” before the Legislative Session ends in mid-September.

Key Government Resources

Below, we’ve provided key places to find both summary-level and detailed information on the state budget, as well as links to budget bill language (BBL), trailer bill language (TBL), and budget change proposals (BCPs).

Administration/Executive Branch Resources:

A. Governor’s Budget/Department of Finance (DOF): This is the official page for the Governor’s Budget, which includes both detailed fiscal information (“budget detail”) and summary level information (also known as “summary” or “A Pages”), and is updated at the January Budget Release, May Revision, and upon signature of the Final Budget Act; you can also find past budgets here.

B. Administration/DOF Health and Human Services Budget Summary: This is the summary of the Health and Human Services programs in the budget. There are also summary charts for the entire budget, as well as a few topic-specific summary chapters, such as Homelessness and Labor and Workforce Development, that may be tangentially related to Health and Human Services. Note: there is much more detail in individual departments’ budgets, see the links provided below, than is summarized here.

C. Department-Specific Highlights: Some departments release a “highlights” document that delves further into their department-specific budget proposals and changes.

a) Department of Health Care Services (DHCS) Budget Highlights

b) California Department of Public Health (CDPH) Budget Highlights

c) California Department of Social Services (CDSS) Local Assistance Summary Highlights

D. Proposed Trailer Bill Language (TBL)

E. Proposed Budget Change Proposals (BCPs)

Legislative Resources:

A. Legislative Analyst’s Office (LAO) 2023-24 Budget: California’s Fiscal Outlook

B. Assembly Committee on Budget

a) Highlights of the Governor’s Proposed 2023-24 May Revision

b) Subcommittee #1 on Health and Human Services

C. Senate Committee on Budget and Fiscal Review

a) Summary of the Governor’s Proposed 2023-24 May Revision

b) Subcommittee #3 on Health and Human Services

C. Proposed Budget Bill Language (BBL): TBD

Stay tuned for our next update at the Final Budget Act!

Endnotes

[i] Department of Finance (DOF), May Revision, May 2023.

[ii] Department of Health Care Services, FY 2023-24 Health and Human Services May Revision Highlights, May 2023.

[iii] Health Access California, 2023–24 CA Budget May Revision Continues Key Medi-Cal Commitments; Legislators Need to Also Improve Covered California. May 12, 2023.